Sorrell on entrepreneurship

Extract from WPP case study

Extract from WPP case study

Sorrell: "If you start as a wire basket manufacturer 25 years ago with two people in one room and your objective in your lifetime is to build a major advertising and marketing services company, you have to do it primarily by acquisition otherwise you’d be dead before you got very far! But the strategy and business model has remained the same. In the early stages, you focus on growth through acquisition and then organic growth becomes more and more important as you pick out the growth segments like new markets, new media and consumer insight. There have been several distinct phases at WPP: 1985 to 1990, 1990 to 1992, 1992 to 2000, and 2000 to 2010.

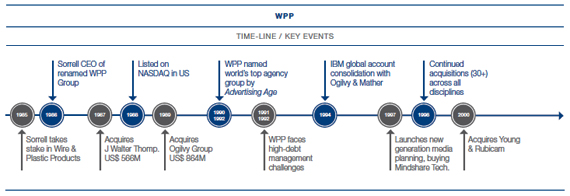

The period from 1985 to 1990 was essentially a growth phase by acquisition, the largest of which were JWT in 1987 (13 times our size) and Ogilvy in 1989 (twice our size). Both were described as ‘hostile’, although there is no such thing as a hostile acquisition. It’s only hostile to the CEO. It’s not hostile to the clients, it’s not hostile to the people inside the company and it’s certainly not hostile to the shareowners.

“We then ran into severe trouble because I over-leveraged the company in 1989.“The restructuring phase in 1991 and 1992 had two parts. The first was the rescheduling of debt. The second was the debt-for-equity swap, which at its time was revolutionary. That was quite a ballsy thing to do as banks really hadn’t focused on service businesses and debt-for-equity swaps in service businesses. We never missed an interest payment or a debt payment despite the challenges.

“The 1992 to 2000 period was an organic growth phase. Having come out of the tunnel of that terrible two years – it was a very tough two years – the basic fabric of the business remained very much intact and growing. The problem was within TopCo, whose name was not the same as the operating companies. This separation was an advantage. So you had WPP and then companies like JWT, Ogilvy, Hill & Knowlton and Millward Brown underneath it. Having come out of that, from 1992 to 2000, we did acquisitions but on smaller scales.

“Then in 2000, we effectively increased our size by 50% with the acquisition of Y&R, and through to 2010 we continued to build the business organically and by acquisition. Every two or three years, we’ve made significant sized acquisitions: 2001, a somewhat controversial CIA acquisition on which, after 9/11 we tried to invoke the material adverse change clause. Despite the fact that we were unable to do so (the takeover panel ruled against us), that has proven to be an extremely successful acquisition. Then in 2005, we acquired Grey. All these acquisitions were around 5, 10 or 15% of our size, and then in 2008, TNS. From 2000 to 2010 we have continued to build the company based on the mantra of new markets, new media and consumer insight – organically and by acquisition. It’s fundamentally the same model. It’s understandable that organic growth has become more important since 2002. If you start in 1985 with a £ 1 million market cap wire basket manufacturer (today we’re £ 9 billion), obviously the emphasis (the law of big numbers) changes the mix by which you grow."

To continue reading, download the

WPP - World Economic Forum case study (pdf, 223 kb).

The full report is available to download from the

Worldwide Economic Forum website (pdf, 16.82 Mb)